Weather:

US Wheat – Limited showers and recent frosts in the Central and Southern Plains offer little benefit, while flooding in the Delta and Midwest has disrupted SRW wheat. The Black Sea remains dry despite some showers, and cold temperatures pose minimal risk. Eastern Europe saw modest improvement, but northwest dryness lingers. Northern Africa had some helpful rain, though Morocco remains in drought.

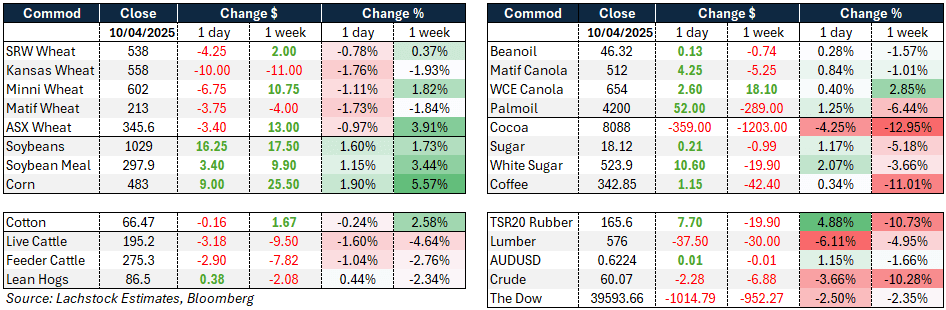

Markets:

Financial markets returned their focus to the likelihood of the US falling into recession and positioned accordingly. Both equities and the USD were sold and while grains chewed through the WASDE, this was the driver of capital flow.

Australian Day Ahead:

AUD is the main driver today. The big question I have is will there be lingering resentment towards the US from the Asian grain consumer – do they alter their buying to exclude the US, even if they are the cheapest grain? or is it simply now accepted that, should tariffs be implemented, the respective Asian governments do not impose retaliatory tariffs and its essentially business as usual?

Offshore

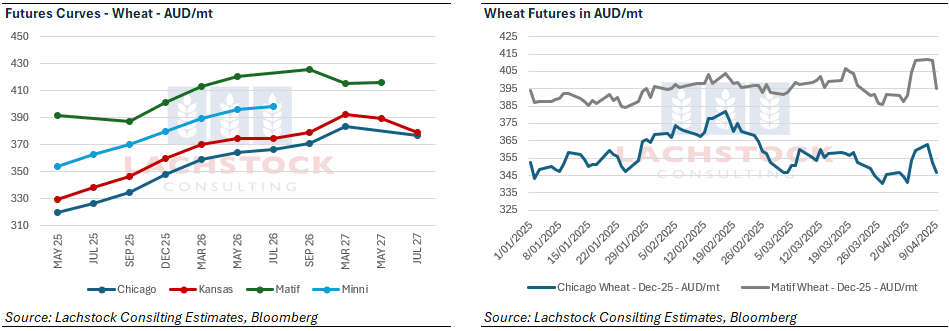

Wheat

Wheat markets reacted negatively to the April WASDE report. U.S. ending stocks were lifted to 846 million bushels, above expectations. The increase came from a combination of higher imports, reduced exports, and lower seed use.

Hard Red Winter and Hard Red Spring stocks saw the largest upward revisions, with Kansas City wheat stocks up 26 million bushels and Minneapolis up 16 million.

Globally, the outlook remained heavy as Chinese import estimates were cut by 3 million tons to 3.5 million, far short of early projections, and Russian exports were only reduced by 1 million tons to 44 million.

Strategie Grains raised its EU wheat production forecast to 128.1 million tons, a 13% year-on-year increase, supported by favorable conditions.

Wheat exports from France’s Rouen port declined from the previous week, while Turkey resumed large-scale Russian wheat imports after lifting restrictions, placing it among the top three importers.

Ukraine raised its minimum FOB wheat export price sharply to $201/ton in April. Although global wheat stocks are relatively tight, the lack of a major weather or demand story has left the market directionless. Despite short positioning, traders are reluctant to act without a catalyst.

Other grains, oilseeds

Corn was the bright spot in the WASDE, with U.S. ending stocks lowered by 75 million bushels to 1.465 billion. The main adjustment was a 100-million-bushel increase in exports, partly offset by a 25-million-bushel drop in feed usage. Still, U.S. corn sales fell short of expectations, and the unchanged 8 million ton.

Chinese import forecast seems ambitious given the geopolitical backdrop and the fact that only 1 million tons have been purchased so far this year. Brazil is expected to be the primary supplier to China.

In Argentina, the Rosario Exchange revised up its 2024/25 corn forecast to 48.5 million tons.

For soybeans, the USDA trimmed ending stocks by 5 million bushels to 375 million. Crush was increased by 10 million while imports were raised 5 million. Despite weak export sales, soybean futures rallied on firm domestic cash markets and robust non-China demand. Processors are active and containerized exports are increasing.

Chinese buyers booked at least 2.4 million tons of Brazilian beans this week, capitalizing on a price dip and strong crush margins.

Argentina’s soybean crop estimate was revised down slightly to 45.5 million tons.

Palm oil stocks in Malaysia rose in March for the first time in six months due to higher production and imports, despite strong festive demand.

Macro

Crude oil prices initially bounced on the news of paused reciprocal tariffs but soon reversed on persistent concerns over a slowing global economy. With oil comprising a third of global energy use, demand is closely tied to GDP growth. Under sub-3% global GDP growth, oil consumption is projected to fall by around 1%.

OPEC is ramping up pressure on members to meet output targets, but Kazakhstan’s Tengizchevoil joint venture plans to raise production, risking further supply pressure. In a worst-case global recession, analysts see downside risk to $50/bbl.

In the U.S., the USDA’s WASDE drew limited market excitement as traders quickly refocused on the broader tariff picture. A weaker U.S. dollar—down 2.1%—added some support to grain markets, helping boost U.S. export competitiveness.

China remains the focal point of trade tensions after President Trump raised tariffs to 125% on Chinese goods while pausing tariffs for other countries for 90 days. China’s leadership held emergency talks on a stimulus package targeting housing, consumption, and tech to offset tariff impacts.

Bloomberg estimates the tariff shock could shave up to 3% off China’s GDP, with several banks lowering growth forecasts. China has also restricted outbound investment into the U.S., escalating the standoff. The yuan fell to its weakest level since 2007, making exports more competitive but risking capital flight.

Meanwhile, the EU will delay its retaliatory tariffs for 90 days to allow talks, and Canada and Mexico remain partially exempt under separate trade conditions.

Australia

Yesterday saw canola bids retrace in the west with a strengthening Aussie dollar and crude oil getting cheaper. New crop bids were down around $40 to $830, with GM at $750. Wheat was bid $375 and barley $365.

In the east of the country it was a similar story, with big losses for canola (-$35 to -$40), with bids around $740 and GM at $650 for current crop, with new crop at $780. Wheat was down slightly to $342 and barley $329.

Sorghum continues to be well bid with strong demand from China, with Australian sorghum outcompeting other origins. Delivered bids into Brisbane/Newcastle are currently pushing $400, which has seen sorghum lose its share in some diets to wheat.

New crop delivered Jan+ APWMG contracts into Melbourne are currently bid around $380. Container exports out of Vic and NSW are strong, buoyed by cheap container freight rates, with over 80kmt done out of both states for the month of Feb.

To read the full report please click here.